tax avoidance vs tax evasion nz

In tax evasion you hide or lie about your income and assets altogether. Tax Avoidance is defined as a practice of using all the legal means to pay the least amount of tax possible.

Taxpayer Income Tax Concept Burden Avoid Evasion Loopholes Etsy Pictogram Investing Financial Problems

The IRD as a matter of policy allows all taxpayers of New Zealand to.

. On 17 December 2020 Inland Revenue issued a draft interpretation statement - Tax Avoidance and the interpretation of the general anti-avoidance provisions section BG 1 and GA 1 of the Income Tax Act 2007 Draft ISIn addition three QWBAs were withdrawn QB 1411 QB 1501 and QB 1511 with aspects of the QWBAs being. Illicit trade is defined in by making tobacco products more and categorizes these motives based Article 1 of the. These 100ms will get taken out of all the shops and businesses and auxiliary service providers to the rural sector in provincial New Zealand.

Justice Reddy defines tax avoidance as the art of dodging tax without breaking the law see. General framework 1429 2. We collect tax on behalf of the Government and your tax helps benefit the New Zealand community.

The reality is more complex. Getting your tax right Its easier to get your tax right when you plan ahead. Tax avoidance is legal whereas tax evasion is illegal and fraudulent.

Your tax pays for public services and thats why its fair when everyone contributes. Tax Evasion vs. This can include efforts such as charitable giving to an approved entity or the investment of income into a tax deferred mechanism such as an individual.

Why avoidance evasion and administration are central not peripheral concepts in public finance 1426 12. It is the avoidance of tax payment without the avoidance of tax liability. Theoretical models of evasion 1429 21.

The difference between tax evasion and tax avoidance largely boils down to two elements. Farms returning 1-4 could have their tax bill topped up to 5 taking 100ms out of provincial New Zealand which is already struggling and giving it Aucklands in the form off income tax breaks. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

Key Differences Between Tax Evasion vs Tax Avoidance. A human rights-based approach to taxation and stricter measures against tax fraud tax evasion and tax havens are urgently needed because a shortfall in tax revenues handicaps Governments in meeting human rights. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments.

Information for anti-money laundering reporting entities This factsheet has useful information for AMLCFT reporting. Tax avoidance uses the loopholesweakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to pay tax at all. Tina orem mar 18 2020 In the tax world however there is a very clear distinction between tax avoidance and tax evasion a point highlighted by the minister of revenues remark about legitimate tax avoidance in the.

Chapter 8 Tax avoidance and tax evasion Introduction Tax avoidance and tax evasion can next section explains the motivation to products illegally traded across decrease the economic welfare for tax avoidance and tax evasion borders. 10 Blacks Law Dictionary 9th ed 2009 Tax Evasion at 1599. Part I Tax Evasion and General Doctrines of Criminal Law 1996 2 NZ J Tax L Policy 1 at 4.

You can also use a tax agent. Logan says its important to distinguish between tax avoidance and evasion. The Independent Expert recognizes that a democratic and equitable international order cannot be achieved without adequate funding.

The major difference between tax avoidance and tax evasion is that tax avoidance is not punishable by law while tax evasion is punishable by law. Unlike tax avoidance tax evasion is a direct violation of a tax provision and is illegal. If you work in New Zealand you have to pay tax on any money you earn.

The intention behind tax avoidance is to optimise and reduce ones tax liability whereas the intention behind tax evasion is to deliberately evade paying taxes which are actually owed. The evolution of tax structures 1426 13. Tell us about tax evasion or fraud Let us know when someones dodging tax - well keep your name and details secret.

Tax Avoidance While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to lower the obligations of a taxpayer. CTO 154 ITR 148 19985 India. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or.

11 John Prebble Criminal Law Tax Evasion Shams and Tax Avoidance. There is a common misunderstanding that differentiates between tax avoidance and tax evasion by claiming that avoidance is legal and evasion is illegal the implication being that if youre only avoiding tax you wont have any trouble. Access financial crime compliance information to mitigate risk prevent tax evasion.

In the tax world however there is a very clear distinction between tax avoidance and tax evasion a point highlighted by the Minister of Revenues remark about legitimate tax avoidance in the recent 60 Minutes programme on New Zealands Foreign Trusts industry. Evasion is a criminal attempt to avoid paying tax owed while avoidance is an attempt to use the law to reduce taxes owed. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

Tell us about tax evasion or fraud. In ordinary use avoid and evade are interchangeable. Tax avoidance vs tax evasion nz.

The Allingham-Sandmo-Yitzhaki model 1429 22. By Campbell Rose and Virag Singh. 8 John Prebble and Zoe Prebble The Morality of Tax Avoidance 2010 20 Creighton L Rev 101 at 112.

Recent tax cases on tax avoidance have created a very fine line between legitimate tax mitigation and deliberate tax avoidance. The United Kingdom and jurisdictions following the UK approach such as New Zealand have recently adopted the evasionavoidance terminology as used in the United States. Evasion avoidance and real substitution response 1428 14.

The difference between tax avoidance and tax evasion boils down to the element of concealing. The much awaited decision on a highly controversial case Penny and Hooper v Commissioner of Inland Revenue 2011 NZSC 95 2011 3 NZTR SC was delivered in 2011. Let us discuss some of the major differences between Tax Evasion vs Tax Avoidance.

The core difference which can be ascertained from these two concepts of taxes is that Tax evasion is a criminal offence and whereas Tax avoidance is perfectly legal thing. Avoidance versus evasion and is there a difference.

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Pdf The Ethics Of Tax Evasion A Comparative Study Of Bosnian And Romanian Opinion

Tax Avoidance Vs Tax Evasion Infographic Fincor

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Explainer The Difference Between Tax Avoidance And Evasion

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

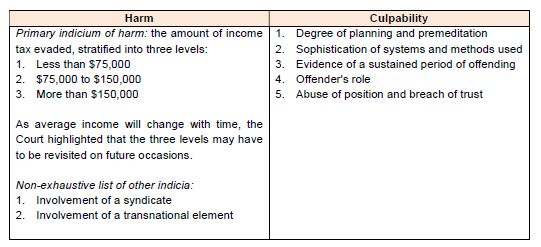

High Court Sets Out New Sentencing Framework For Tax Evasion Offences Tax Singapore

Germany Is Putting Pressure On Dubious Tax Arrangements Ecovis International

Tax Evasion From Cross Border Fraud Does Digitalization Make A Difference In Imf Working Papers Volume 2020 Issue 245 2020

Masters Of Tax Evasion Evasion Fiscale Infographie Apprentissage

What Is Tax Avoidance And Tax Evasion Explain With An Example Quora

Pdf Tax Havens Tax Evasion And Tax Information Exchange Agreements In The Oecd Tax Havens Tax Evasion And Tax Information Exchange Agreements

What Is Tax Avoidance And Tax Evasion Explain With An Example Quora

Tax Avoidance Tax Mitigation And Tax Evasion

Requalification Of Tax Avoidance Into Tax Evasion

A Primer On Tax Evasion In Imf Staff Papers Volume 1993 Issue 003 1993